Are you working a written financial plan to accomplish your goals?

You are part of a small minority if you are. Personal financial planning isn’t something we are taught in any level of schooling, including business schools. Specialists seek out the training for business and career purposes, and there aren’t nearly enough to go around to the millions and millions of people who need it. Most likely you’ve never given it serious thought. This article may give you something new to consider.

Let’s start with the psychology of this. Committing to a comprehensive financial plan means first overcoming inertia. For many, it’s never been offered. They’ve never seen one, nor do they know anyone else who has one. How important could it be? I’ll hit you with some stats below. Besides the inertia is the stress of the unknown. People avoid the doctor, dentist, and financial planner for a similar reason: the risk of bad news. If things aren’t rosy, now’s the time to find out and fix it. Once you decide it’s worth devoting some energy to the effort, there are wonderful payoffs.

The Benefits

Goals planned are much more likely to be accomplished. The process helps recognize risks and opportunities that might be missed, allowing us to take more control. With the professional planner guiding the process, you can have confidence that your plan is made with the perspective of best practices and what has worked for others. It’s a bit of a commitment to engage in a plan, especially at the beginning when you have to gather information; the benefit is that only needs to be done once. Going forward, new information and changes are more and more easily included.

This is a process of learning, growing, and choosing wisely. Done well, it actually becomes fun seeing how much control you can take. However, plans are sometimes commissioned and then ignored. This has often been because the planner didn’t follow up effectively with an action plan. The planning process covers insurance, investments, intelligent use of debt, education planning, will, trusts, and of course taxes. Any part of your life associated with a dollar sign. My opinion is that strict budgets are overrated—more important is an understanding, a “feel” of what matters and what doesn’t. Focus on the pieces that matter and don’t sweat the small stuff.

Real World Plans – A PivotPoint Specialty

An important part of most any plan is retirement saving. Most planners, certainly CFP® professionals can answer this fundamental question: if I save $100 every month into an index fund that historically returns 10.0% per year, how much will I have in 20 years? This is the bread and butter of financial planning. A planner will break out her Excel program or HP 12C and give you the answer: $75,936.88. Great! But of course, it’s not going to actually be that amount; we know it will actually be something else. But that calculation and that single figure far too often represents the end of the projection. That calculation is not robust. You can’t really do much more with it.

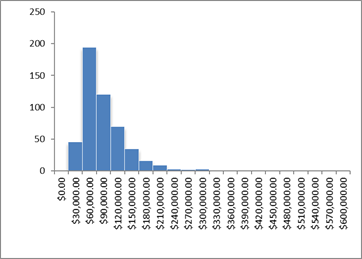

This picture is the best answer to that false certainty:

It’s the result of 500 simulations of the market over 20 years, using real-world variability. This is what your financial planner should be doing for you. It considers how that index fund works in the real world. It varies. In the long run, we have a pretty good idea how much it varies, and that allows the planner who knows how to get a robust result, that gives best case and worst-case scenario, along with the average one. This picture tells us that over 20 years your can count on at least $30,000 final result. It additionally tells us that with some luck you might see $120,000 or more. You need to know both things.

As time goes by and you need to tweak your plan—as everyone needs to—this will give results that help you make the best choices. Sometimes the average answer is fine. But sometimes the worst-case scenario is everything. Example: what are the chances I run out of money when I retire? A picture like this is the only way to get a feel for the danger. Even for clients that may not be interested in this level of detail, the planner should use it all the time for analysis and recommendations.

Finally, I like these two takes from other writers on financial planning:

- CFP® Board: Value of Financial Planning | FPSB

- Charles Schwab & Co, Inc.: 5 Ways Financial Planning Can Help | Charles Schwab