The goal is to crush the market – Updated February 2023

Overview

We manage a range of portfolios for the benefit of our clients. They are numbered 0-10; as return & risk increase, so do the numbers. PivotPoint 9 is our most aggressive portfolio using our main selection process – mean-variance analysis (MVA). You can read more about those portfolios elsewhere. PivotPoint 10, our most ambitious portfolio for growth, is built and updated using an entirely different approach.

The Little Book that Beats the Market, by Joel Greenblatt, was first published in 2005. Greenblatt was and is a hedge fund manager with spectacular success. Like many hedge fund managers, he focused his energy on one strategy, worked it and refined it into a masterpiece. It’s very easy to find the book or a summary of the book, so I won’t go into much detail here. The book outlines a method for finding “good” companies that are “cheap”. “Good” and “cheap” are very well defined. The strategy is based on the fact that the overall market overlooks many stocks. News media focus attention on a very few of the thousands of equities out there. This is one methodology for finding and profiting from the overlooked, perhaps boring company. Another financial author, Peter Lynch, of One Up on Wall Street

fame agrees. He writes that the #1 feature of a “perfect stock” is that it sounds dull or even ridiculous:

“The perfect stock would be attached to the perfect company, and the perfect company has to be engaged in a perfectly simple business, and the perfectly simple business ought to have a perfectly boring name. The more boring it is, the better…”

This style of investing favors the long-term investor who does NOT have billions to spend like the big fund managers. You can read the details in either of those books, but the bottom line is that TOO big an investor would move the market too much on these smaller stocks and thus defeat their own goals. Also, this method takes some time to work reliably…fund managers need results this quarter and every quarter. Joel Greenblatt, running his own company, is willing to wait, but most are not.

Since these stocks are already considered to be “cheap” there’s not a lot of downside in the portfolio. Out of 15 stocks, a few will prove to be dogs, but most often they’ll just languish where they are and never “pop”. Limited downside is a very good thing. Meanwhile there’s plenty of upside… the winners really win! We watch the overall portfolio performance daily, but not necessarily the individual performance of the stocks.

PivotPoint’s Implementation

Greenblatt gives the details for finding stocks that fit the bill, then suggests grabbing a dozen of them more or less at random, waiting a year, then screening again for a new batch. That’s a wonderfully simple way for the amateur investor to get the benefits of value stocks. We’ve added a few other criteria for getting in and out of these stocks:

- We want 15-20 small cap value stocks with market capitalization between about $1B and $5B. This is historically the sweet spot for companies about to hit a growth spurt. This number of stocks provides more robust diversification than you might think; diversification is a good thing.

- Spread the stocks out over sectors (like healthcare) and industries (like biotech). We don’t want too many eggs in one basket. But… these days the companies that fit are often healthcare companies. Much more than other sectors.

- Secret Sauce for when to add a stock and when to remove it, instead of a simple 12-month holding period.

Portfolio Update – February 2023

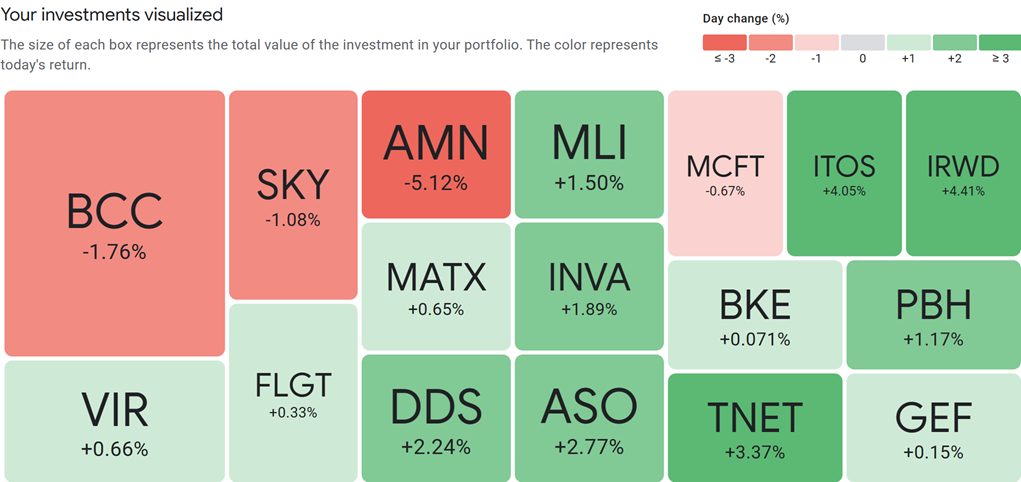

This is the current composition of PivotPoint 10, at this writing. It’s a down market day, so there’s more red than green; but this portfolio is usually less down than the overall market for the reasons explained above. You probably won’t see too many companies you recognize. That’s kind of the genius of it. You can dig in by just Googling the ticker symbols. That’ll get you to their backstory.