The big picture of Social Security…

First Question – How Much Am I Getting?

Until we know just how much our benefits are going to be, there’s no way to start planning. All Social Security benefits are based on the Primary Insurance Amount (PIA,) which is calculated by using your work history. Your PIA is the benefit you’ll receive at Full Retirement Age (FRA). Cost of Living Adjustments (COLA) are applied to the PIA to keep our benefits even with inflation–which is the mortal enemy of fixed incomes. It’s not very important for most of us to understand that level of detail (“I just need to know how much!!”)

Your PIA is found on your last mailed Social Security statement. I strongly suggest you gain online access to your Social Security information if you haven’t already. If you’ve created a “my Social Security” account and did it before September 18, 2021, you’ll have a Username/Password combination. If you created account after that date (or haven’t yet) you use Login.gov to gain access to Social Security records. Once created, you can use the same Login.gov account for access to IRS records. Login.gov is worth the effort! You’ll need a phone number or email address to gain access. Every login to this sensitive information requires entering a one-time code sent to your phone or email.

The Next Big Question – When Should I Apply for Retirement Benefits?

When we talk about Social Security, we usually mean Retirement benefits. There are other types of benefits under Social Security including:

- Disability

- Spousal & Family

- Survivor

- Supplemental Security Income (SSI)

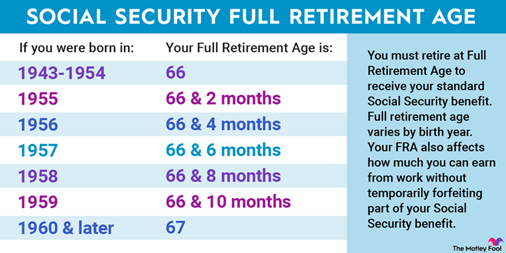

More on these 4 later, back to Social Security retirement. Retirement benefits can begin as early as age 62 or as late as age 70 for most beneficiaries. Your Full Retirement Age—which is somewhere in between—will vary. Here’s the table, courtesy of The Motley Fool:

There’s a price to pay if you need to take retirement benefits early. The calculation of your benefits is based on life expectancy. When you start taking benefits early, your benefits are reduced by enough to make the total benefit equal if you live exactly that long. There’s a fairly involved formula to make the adjustment, I’ll dig into that in future article. If you start taking retirement benefits and change your mind within 12 months, you can wiggle out of it. That’s happened quite a bit lately because of early retirement caused by the pandemic. Please contact us if you’ve done this and you’re having second thoughts.

What About the Other 4 Types of Benefits?

Disability

As mentioned, the core benefit of Social Security is the retirement benefit system. Retirement rules power the family and survivor benefits described below. Social Security disability is a separate, though related system.

To qualify for Social Security Disability Insurance (SSDI) you must:

- Have worked in jobs covered by Social Security

- Have a medical condition that meets Social Security’s very strict definition of disability

In general, you’ll need a total of 40 work credits over your career to qualify, which is the same standard for retirement benefits. SSDI is targeted to help qualified beneficiaries whose disability is major and keeps them from working for at least a year. For partial disability coverage, you’ll need to purchase a policy from a private company. Aflac may be the best known.

Spousal & Family

The spouse and dependents of a person who has earned benefits can claim benefits based on the wage earner. The spouse must be age 62 or caring for a minor or special needs child to receive benefits. The spousal benefit may be up to 50% of the benefit of the wage-earner. As in all cases, benefits based on qualifying age are reduced between age 62 and full retirement age.

Divorced? You may still qualify for benefits based on your former spouse’s career. You’ve got to meet all these requirements, though:

- have been married to your ex-spouse for at least 10 years,

- have been divorced two years or longer,

- be at least 62 years old,

- be unmarried; and

- not be entitled to a higher Social Security benefit based on your own work history.

Survivor

Spouse, divorced spouse, children, and parents may be able to receive benefits upon the death of a Social Security wage-earner. The fairly complicate rules can be read here.

Supplemental Security Income (SSI)

The SSI system is not based on earning wages over a career; it’s meant to provide a lifeline to citizens and resident aliens who have few other resources. Those that can potentially qualify:

- Aged 65;

- Blind; or

- Disabled

Do I Pay Taxes on My Social Security Income?

If your combined income from all sources is above a certain level, you may owe income taxes on a portion of your Social Security benefits. Figuring income tax liability correctly has many facets, which is why I used the word “may”. Your tax liability on Social Security benefits will be based on a percentage of the total. It’ll be either 0% of your benefits, 50%, or 85%. Here’s a table that tells most of the tale:

|

|

50% of Benefit |

85% of Benefit |

|

Individual Filers |

Combined (all sources) Income of |

Combined Income |

|

Joint Filers |

Combined Income of |

Combined Income |

Your tax liability may be slightly more complicated, depending on where the earnings come from. If you are over the minimum combined income, the taxable portion of your SS will be the lesser of 50% or 85% or your SS income and another calculation based on your Modified Adjustable Gross Income (MAGI). No need to get into those weeds here; the table gives a good approximation.

Anything Else?

There are at least two specialty cases to mention. They both require a deeper dive (which I’ll write soon)

-

Earnings test with early benefits

If you take retirement benefits early, the IRS will look very carefully at any earned income. The limit for 2023 is $21,240; any income over that will be taxed. Other types of income, including pensions or investments. The government doesn’t want to encourage taking retirement benefits early while still earning income.

-

Windfall Elimination Provision (WEP)

It is possible to have worked most of a career for some level of government, outside the U.S, or for a non-profit and not have paid much in Social Security taxes, but have contributed to a pension. This situation can warp the formula used to calculate partial retirement benefits and make a high wage earner appear to be a low wage-earner and give that person extra benefits. The WEP reduces the SS benefit amount to compensate. If you’ve paid into SS with 30 years of “substantial earnings” this does not apply to you.